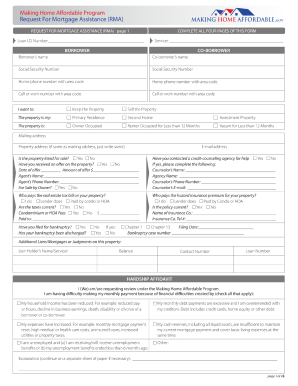

Who needs RMA?

If you’re dreaming about your house but don’t have enough money to buy it, mortgage can help you cover the full cost. This is a loan that an individual pays back over set period of time. However, sometimes people who have taken mortgage experience financial hardships that don’t allow them to make regular mortgage payment. In this case they may ask for financial assistance by filling out Request for Mortgage Assistance.

What is for RMA?

Request for Mortgage Assistance is an application for mortgage modification under Making Home Affordable program. It aims to change some terms of the mortgage loan to make it more affordable for a payer. Mortgage modifications may concern the change of interest rate, extension of the initial loan period or even red?ton of the regular payments to individual’s income. To apply for mortgage modifications a person doesn’t necessarily need to have a good credit score unlike refinancing which implies taking additional loan to cover the previous one.

Is RMA accompanied by other forms?

There is a package of documents that must accompany Request for Mortgage Assistance. It includes:

- Copies of federal tax returns and W-2 for the last 2 years

- Bank statements for the last 2 years

- Hardship affidavit that explains why an individual is unable to pay back the loan and what is needed to resolve the issue

- Debt to Income Ratio that includes all individual’s debts and income

- Net present value statement.

When is RMA due?

There is no specific due date for the request. A person experiencing financial difficulties may apply for mortgage modification.

How do I fill out RMA?

The request contains seven pages and six sections. The minimum information that must be provided is applicant’s identifying information, income, expenses and financial assets, description of the hardships that prevent individual from paying back mortgage loan, etc.

Where do I send RMA?

Completed request is sent to the local loan modification unit and the U.S. Department of Treasury.